Navigating today’s maritime risks takes more than a basic P&I policy. From regulatory crackdowns to cyber sabotage, your vessel might be more exposed than you think. Maritime Risk Management explores the real threats and the smart insurance tactics that can protect your fleet. Download risk checklists, run an exposure test, and book your free audit now.

2025 has brought unprecedented challenges to vessel operators across Europe and the UK. The recent North Sea collision in March, delays at EU ports for underinsured ships, and GPS jamming incidents in the Baltic aren’t isolated events — they’re signs that traditional marine insurance models are dangerously outdated.

If your coverage hasn’t been reviewed in the last months, there’s a real risk you’re exposed to claims rejections, port denials, or worse.

“Insured” doesn’t always mean covered

A troubling pattern has emerged in UK and EU waters: vessels arriving with paperwork that looks compliant — until an incident or inspection proves otherwise.

In the UK alone, over 340 vessels were challenged between Q4 2024 and Q2 2025 for incomplete or invalid documentation in the Channel and North Sea zones. Meanwhile, new EU legislation adopted in April 2025 now requires proof of insurance even for vessels transiting European coastal waters.

Failure to comply can now lead to fines, delays, or outright denial of entry.

Download: EU–UK Compliance Checklist

Geopolitical risk is driving up premiums

War risk premiums for high‑tension routes like the Gulf of Aden and Red Sea have risen by more than 60% this year. Operators using Suez or Hormuz corridors now face heightened scrutiny from insurers — especially on routing transparency and cargo declarations.

Static clauses and outdated policy language often leave vessel owners exposed during disputes.

Europe’s cyber risk zone is expanding

In 2025, cyber‑physical threats are disrupting port calls and navigational safety — with claims often falling into policy grey zones.

A key culprit: “silent cyber” exclusions that disqualify digital disruption claims unless specifically declared ( e.g., LMA5403 — Marine Cyber Endorsement — which removes cover for any cyber-triggered losses unless explicitly endorsed.)

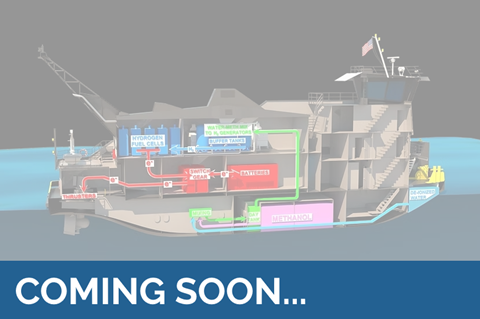

The rise of smart & parametric marine insurance

European carriers are turning to parametric insurance — payouts triggered by wave height, weather or equipment failure. Others are adopting smart‑tracking policies, where sensors and voyage data give insurers a live feed — and owners a faster claims process.

It’s not just about compliance anymore — it’s about control.

Request: Smart Policy Consultation

Is your coverage ready for today’s waters?

At Maritime Risk Management, we support vessel owners, charterers, and brokers across the UK and EU with tailored marine insurance strategies. We’ve advised fleets navigating the Baltic, Suez, and North Sea corridors — helping them reduce exposure and avoid costly detentions.

Now’s the time to check your coverage, fix the gaps, and get ahead.